How to Complain About a Loan Provider

If you do have an issue with any such loan provider then it would be important to send an initial detailed email explaining your situation. Get a receipt for delivery through your email settings. My guess is that some of you may have done this several times over. To be honest, payday lenders in particular don’t tend to do themselves any favours. When questions are sent to their customer service, these messages are often not replied to, no matter how many times you contact them. This is something that I see frequently posted on the consumer review websites and it has happened to me personally in the past.

After this, it would be recommended to send a complaint to the trade association (if the lender is part of one). Around 90% of the market is known to be attached to a trade association. Although these have limited powers, this will get some attention to the issue. Sending an email to the Financial Ombudsman Service (FOS) would be the next step and it is important that you have collected necessary evidence for your concerns. The trade associations should be advising you on this anyway. You can learn more About Them Here. That post also covers the Good Practice Customer Charter that itself has been designed to improve customer experiences.

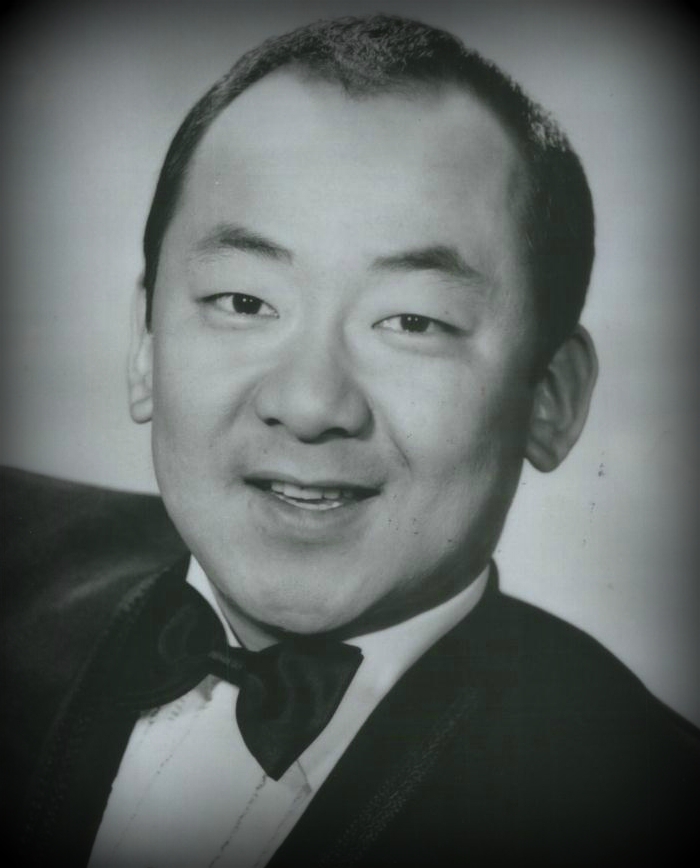

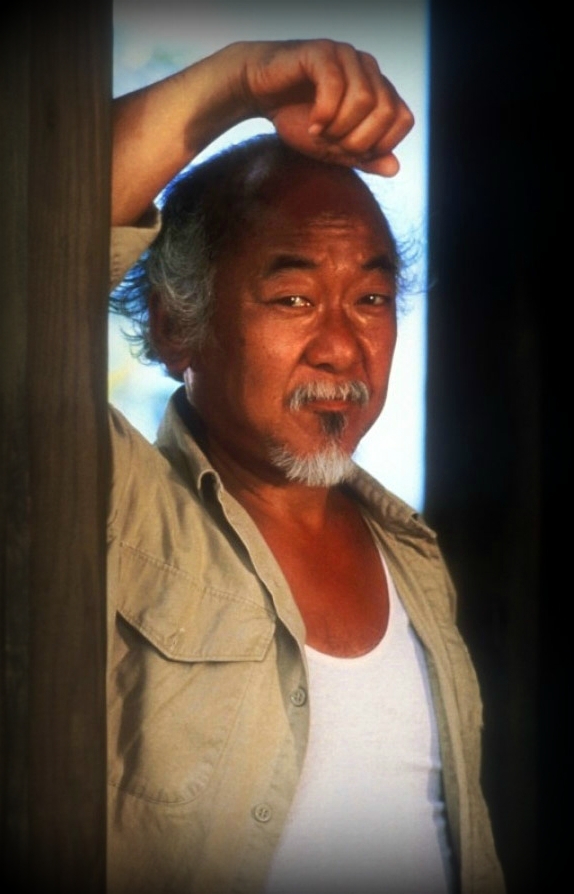

In the meantime, another thing that you can do is to let other consumers know about your experiences. Sending a detailed review on a website like Trustpilot would be our recommendation. The Review Centre is a popular site, but their financial coverage isn’t quite as extensive. Debt charities may also open their ears. Letting us know here at Miyagi can also help you. If we see negative press about anyone discussed here then we will blog about it openly if this is a regular occurrence. Payday loan complaints in particular are very common these days and so it is important to speak up and let others know about your experiences.